Just the mention of budgeting can conjure up thoughts of scarcity and cutting out fun, enough to have even the most seasoned entrepreneurs shaking in their boots. But it’s time to reframe how you think about budgeting for your business.

Your financial numbers represent the reality of your company’s performance, regardless of whether you know them or monitor them. Can you confidently answer if you have sufficient funds to expand into a new office space, hire additional staff or launch a new product line? How can you make informed decisions if you don’t know your numbers? Without a clear understanding, decision-making becomes guesswork.

And what if you have a lot more money going out than coming in? There’s a real danger in not knowing. As you run the daily operations, it’s easy to take your eye off the proverbial financial ball. As I experienced firsthand, things like a runaway train can quickly get out of control. Overspending, missed opportunities and potential financial distress can quickly derail even the most promising ventures.

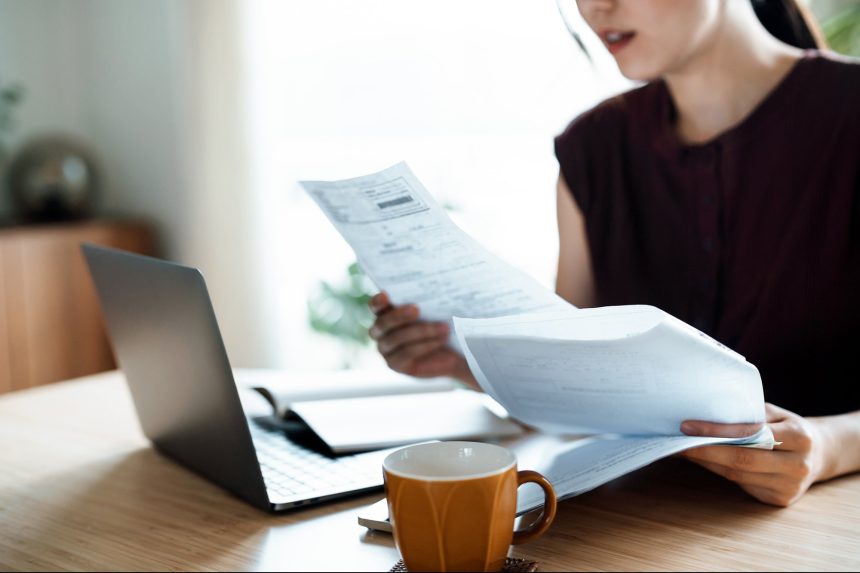

One of the first things I do with my clients is review their finances. By reviewing their financial situation in detail, we can identify problem areas, set realistic goals, and create a budget that aligns with their business priorities.

Related: 5 Ways to Build a Business Budget for Maximum Success

Budgeting doesn’t mean cutting everything out or sacrificing growth. Rather than focusing on limitations, consider it a roadmap to financial freedom, enabling you to align expenses with your business priorities. Yes, sometimes you may need to run lean, but it’s not permanent; it’s “just for now.” View it as a temporary strategic phase that allows you to gain control over your finances and allocate resources intentionally for future opportunities and growth.

It is not just about controlling spending but also figuring out how to increase sales and revenue. How can you make more money? Start by identifying new market opportunities or untapped customer segments. Innovate your product or service offerings to meet market demands. Improve your sales strategies through targeted marketing campaigns and leveraging social media/digital platforms to reach a broader audience. Consider partnerships or collaborations that can open new revenue streams. By focusing on these aspects, you can create a proactive plan that manages expenses and drives growth and profitability.

Related: This Is How Entrepreneurs Can Achieve Financial Fitness

Regular review and adjustment

A crucial aspect of effective budgeting is comparing your budget to your actual spending. Regularly reviewing this comparison helps ensure that your spending aligns with your budget and highlights areas you might need to adjust. For example, if certain expenses are consistently higher than anticipated, you may need to revise your budget or find ways to reduce those costs.

Additionally, income and expenses can fluctuate, so it’s important to tweak and adjust your budget monthly. This flexibility allows you to respond to changes in your business environment and ensures that your budget remains a useful tool for financial planning.

I personally experienced how important it is to have a budget. Even with my background as a CPA, I didn’t take my own advice, and as I rapidly expanded my restaurants, opening one a year, I became heavily involved in the openings and didn’t pay close attention to the financial details. When I finally took a moment to slow down and look, it became apparent that we were spending more money than we were making, despite being busy and having high sales.

By implementing a detailed budget and reviewing it month to month, I was able to identify discrepancies and areas where we were overspending. This regular review allowed me to make necessary adjustments and turn around most of the locations, getting them in line and operating successfully. This experience brought forward the importance of diligent budgeting and financial monitoring.

Related: 4 Marketing Budget Hacks That Will Boost Your Business in 2024

Practical tips for effective budgeting

- Set Clear Goals: Define what you want to achieve with your budget. Whether it’s saving for expansion, reducing debt, or increasing profits, having clear goals will guide your budgeting decisions.

- Track Expenses Diligently: Monitor every expense using accounting software or budgeting apps. If you prefer, use a spreadsheet. Whatever the choice, make sure you are tracking.

- Regularly Review Your Spending: Ensure it aligns with your budget.

- Adjust as Needed: Budgets are not set in stone. If you notice certain strategies aren’t working, don’t hesitate to make adjustments.

- Involve Your Team: Ensure that key team members understand the budget and their role in adhering to it.

Read the full article here