There are several important metrics that every business owner should know and understand. One of these metrics is the breakeven point. The breakeven point is the level of sales at which a company’s revenue equals its expenses, resulting in zero profit or loss.

The reality is that only some sales are profitable, and some cost you money. That’s where the breakeven point comes in, which is the minimum revenue you need to make to cover your costs and keep your business afloat.

Despite its crucial role, many entrepreneurs need to pay more attention to knowing their breakeven point. This knowledge is essential for making informed financial decisions and ensuring profitable business.

Why It’s Important to Know Your Breakeven Point

Knowing your breakeven point is crucial for any business owner for several reasons, as it helps you determine the minimum amount of sales you need to make to cover your expenses. This is especially important when it comes to pricing your products or services. It allows you to set prices that will generate enough revenue to cover your costs and enable your business to profit.

Knowing your breakeven point can help you make more informed decisions about expanding your business. Whether you’re considering investing in new equipment, hiring additional staff, or expanding your product line, understanding your breakeven point can help determine how much additional revenue you need to generate to cover the new expenses and ensure your business remains profitable.

Your breakeven point must include the salary you pay yourself to meet your financial obligations. Many business owners are paying themselves last, and this must stop. You need to include your salary in your expenses.

Calculating Your Breakeven Point

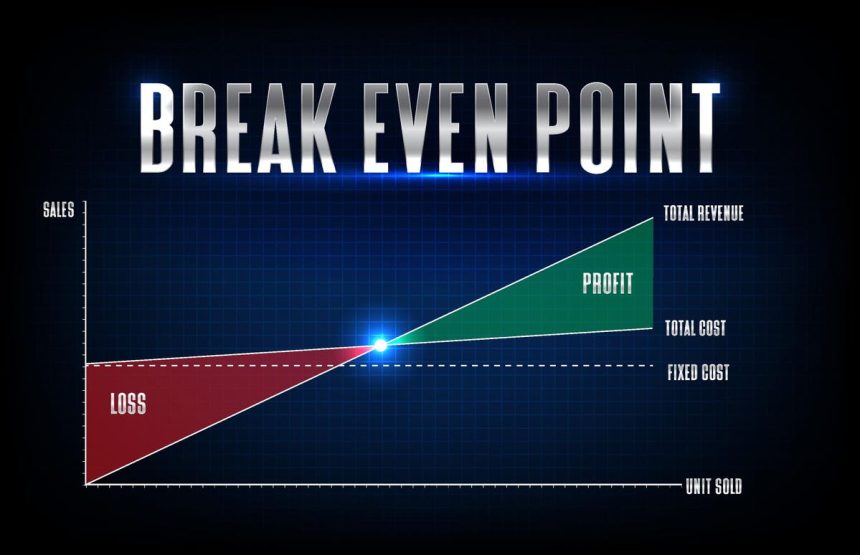

Calculating your breakeven point involves determining your fixed and variable costs, which are the costs that remain constant and those that vary depending on your level of production or sales, respectively. Once you know these costs, you can use a simple formula to calculate your breakeven point:

Breakeven Point = Fixed Costs ÷ (Sales Price per Unit – Variable Costs per Unit)

Monitoring Your Breakeven Point

Knowing your breakeven point is one thing, but it’s equally important to monitor it regularly. As your business grows and expands, your expenses and revenue will change, and so will your breakeven point. By monitoring your breakeven point, you can identify trends in your business, such as increasing expenses or decreasing sales, and take action to address any issues before they become major problems.

The bottom line is that the breakeven point is a crucial metric that every business owner should know and understand. Knowing your breakeven point can help you set prices that cover your expenses and generate a profit, make more informed decisions when it comes to expanding your business, and monitor your business’s performance over time. By taking the time to calculate and monitor your breakeven point regularly, you can ensure your business remains profitable and sustainable for the long term.

Read the full article here