Seth Schechter’s book Martini Wonderland is a short memoir of the author’s years spent managing the affairs of Sydney Frank, the late billionaire and drinks magnate who has several claims to fame, including discovering Jägermeister, inventing drinks promotions and transforming vodka into a ultra-premium beverage.

While the book does touch on some traditional elements of wealth management, it does a great job of illustrating the sometimes outrageous requests of billionaires. Schechter’s story starts with a job advertisement that seems too good to be true and ends with him hacking his way through untamed jungle in Bermuda in search of a perfect piece of land for his employer’s dream golf resort.

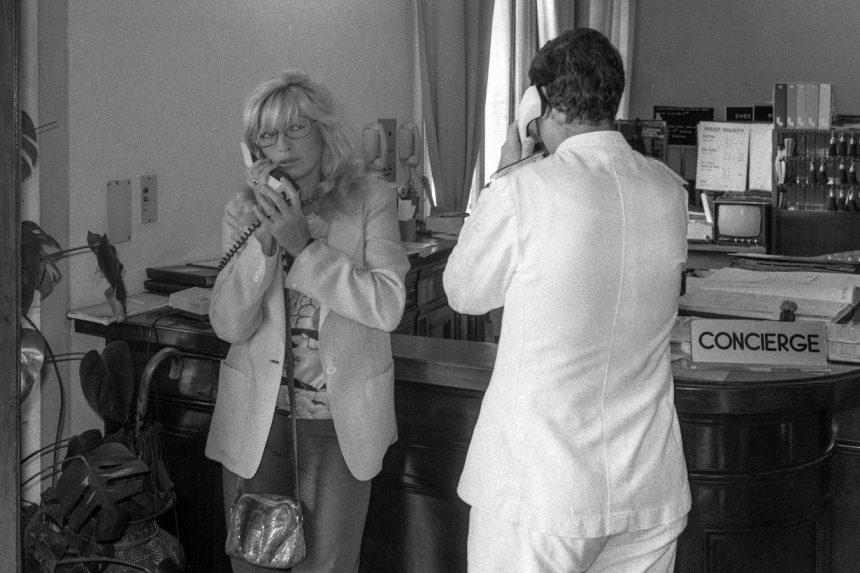

It’s a book with scenes that many in the family office community will find familiar, though definitely reflects rather inefficient structures of another time, where the three-martini lunch (or in this case, a Grey Goose martini before breakfast) was still common. The modern family office of today is indeed very different, with focused operations and use of the latest technology to manage a family’s wealth and interests.

It’s managing these interests outside of the wealth that Martini Wonderland captures so well and what the family office industry often seems to cast aside, a secondary afterthought. Preserving and growing wealth as a first priority makes sense, but the scope of services that family offices need to provide extends beyond this and the expectations of ultra-high net worth individuals will always be demanding.

From Lifestyle Management to Essential Services

Thankfully, just as wealth management has evolved and created a support industry of tools, advisors and service providers, there has been a similar evolution in offerings to help solve the other interests of family offices, with new products and services emerging across categories of lifestyle management, health and wellness and more.

The term ‘lifestyle management’ conjures images of overseeing glamorous events and brokering yachts, which it often entails, but there’s also practicalities around security and logistics too. Companies like Veltracon Lifestyle have emerged to fill the in-house need for this, being a partner for their clients to call on at all hours when there’s a problem to solve.

Partner and CEO at Veltracon Lifestyle, Patrick Gruhn, explained in a recent conversation that they’ve seen a surge in growth from family offices over the last few years, as management teams realize the need to service greater demands from their principals that they don’t have internal expertise to handle.

While this can be sourcing collectable artworks, accessing exclusive education opportunities or arranging unobtainable tickets, Gruhn also highlighted the need to solve urgent problems, like travel emergencies or security issues.

“Our company assists some of the wealthiest, prominent individuals on the planet with their wishes for unobtainable items or solutions,” Gruhn said, though noted their focus on solving challenges at the highest level, “Generally we’re the company you call when you need to overhaul your private protection detail or get your art collection assessed, not to book a table at a restaurant or send flowers.”

Leveraging Technology to Address Modern Challenges

There are also plenty of more traditional operational responsibilities that family office teams are called on to manage, many made harder by a family spread out across the country, or internationally, as is usually the case.

Digital solutions like the Nines household management platform, which provides a centralized operating system to manage multiple properties and teams, brings estate management into the 21st century, while governance platforms like Trusted Family and Way2B1 provide solutions to pick up where the capabilities of wealth management platforms end, allowing family offices to consolidate all relevant information securely as well as enabling collaborative decision-making regardless of how spread out a family is.

Outside of these there’s also a burgeoning wellness framework emerging to support the family office community. Whether it’s concierge medical solutions like Private Medical, which provides a family-oriented health service with its own global network of specialists, or premium health insurance providers like PassportCard, designed to offer instant access to healthcare services worldwide whilst avoiding any traditional administrative red-tape, the focus is on providing accessibility and efficiency with a more dedicated service approach.

International complexities are often a driving reason that family offices seek outside support, requiring skills beyond simple administrative processing. “Understanding that healthcare is no different to financial investment, especially on an international level where aspects of compliance, policy modularity and coverage term kick in,” says PassportCard CEO of EU Region, Eithan Wolf, on how they manage the challenges of delivering high-quality service levels to global family offices.

Supporting family offices in their efforts to advise and manage private family matters, these and other emerging companies are fulfilling an important role outside of traditional wealth management, particularly for newly established family offices that often overlook these so-called ‘soft services.’ Like anything, better foresight and upfront planning should result in more efficient partnerships and greater value.

Read the full article here