Yusuf Qasim, President of Payments Optimization at Zelis.

Paper payments have become a thing of the past for many businesses and consumers across industries. The emergence of digital payment companies such as Stripe, Venmo, PayPal and Zelle; the adoption of such technologies by large banks; and no-touch pandemic propellers have made electronic transactions the norm in many industries—but not healthcare.

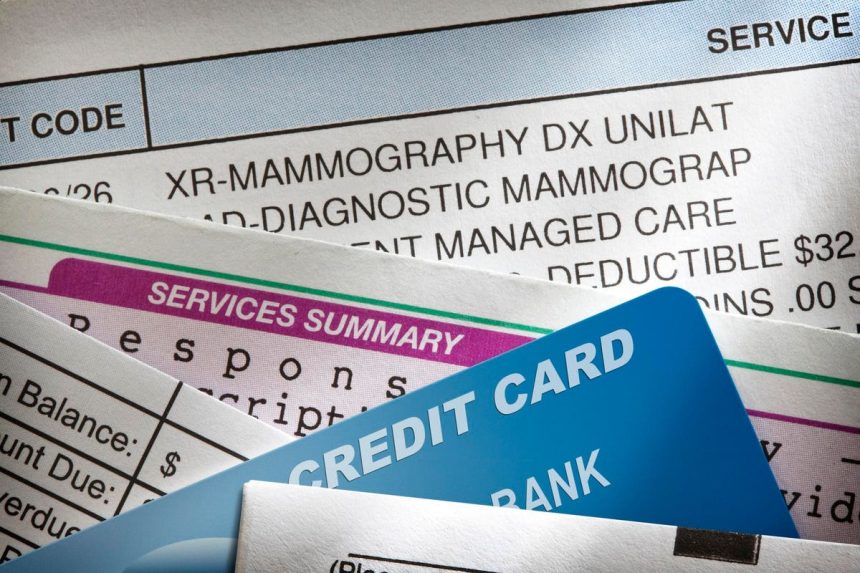

In a time where you can transact a car or even a house online, the continued reliance on paper for healthcare payments can be costly. Studies have found that there are increased costs associated with using paper checks, not considering the overages of increasing mail theft and fraud.

Paper payment methods can be a source of friction for all parties in the healthcare continuum. Yet, they persist to the tune of around $450 billion annually, according to a private independent healthcare payments survey Bain & Co. conducted on behalf of my company in 2018. Results were based on the responses of 460 acute, ambulatory and dental providers. Rising costs—coupled with the introduction of new tax proposals, regulatory changes and an ever-evolving legislative landscape—have some companies converting to a digital payment infrastructure.

As a co-founder of a payments solutions company and the leader of a payments business that partners with payers to provide financial solutions to providers, I am thrilled to see the healthcare industry moving toward digital payments. However, there are some hurdles to overcome.

Recent Legislative Updates And Guidance

Since the late 1990s, the U.S. government has led a private-public effort to move government agencies and American businesses to use electronic payments. For example, a federal government mandate, EFT ’99, required all government payments, other than tax refunds, to be made electronically. Convenience, efficiency, security and a broad range of payment options were among the objectives of the law, and the government called on the private sector to lean in and help support initiatives to move to electronic payments.

Provisions in the Affordable Care Act, including the adoption of an electronic funds transfer standard, were implemented to incentivize the healthcare industry to move toward electronic payments. Most recently, the Centers for Medicare and Medicaid Services published guidance in March 2022 related to automated clearing house, virtual credit cards and electronic payments, which could support the transition away from paper checks to electronic payment methods.

CMS’s guidance confirmed that VCCs and other electronic payment modalities may be used for payment, but health plans may not force physicians to accept them. Notably, while the guidance supported the use of all electronic payments, the guidance also clarified that health plans were not required to provide paper checks as an option for provider payments. From my perspective, the guidance from CMS marked a step forward in advancing the modernization of healthcare payments.

Hurdles To Adoption

Healthcare’s transition to electronic payments is not without its own challenges. Some providers, for example, take issue with the VCC. So, what are they?

VCCs—healthcare’s version of credit cards—are basically credit card payments without the cards. Like credit cards, VCCs can transfer money without the paperwork required by traditional methods and without requiring the input of sensitive bank account information. VCCs also include a usage fee. Payments via credit cards are relatively new to healthcare, and, like with other industries, there have been some growing pains.

At a meeting with a Health and Human Services advisory board, some providers submitted concerns about updating the claims and payment transmission electronic standards in a way that would allow better reassociation between remittance advice and VCCs. Their complaints included that the fees were high, and that they should be able to opt out of the cards and choose a different payment method.

This tells me that the industry needs to get better at explaining payment options and providing clear instructions for selecting preferred payment methods. For example, clarify that a provider may opt in and opt out of VCCs as their preferred method for receiving payments and discuss other electronic payment modalities (e.g., EFT).

Security is another concern I’ve observed providers have with electronic payments. Despite banks’ cybersecurity systems, fraudulent activities are very real. Identity fraud resulted in a loss of $52 billion in 2021. It should be no surprise then that some providers might be reluctant to share banking information, especially if they don’t have an established relationship with a payer. Additionally, while the promise of quicker payments is appealing, providers’ staffing shortage could leave them without resources to initiate and manage the upfront administrative processes to establish e-payments with payers.

Ultimately, it’s important that we, as payers and service providers, offer incentives for providers to move toward electronic payments, not obstacles. For their part, providers should keep their banking records current and monitor their accounts and transactions; they should also only partner with trusted entities that have rigorous standards for information retention.

Advanced Digital Payments In Action

From my perspective, healthcare’s current financial system is largely fragmented and not built to withstand modern compliance challenges, security concerns, operational costs and preferences. The time is now for the payers and service providers to consider how they can help the healthcare industry shift to electronic transactions and ultimately modernize the healthcare financial experience for all.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

Read the full article here