Ask the teen in your life for their thoughts on your outfit, and you might get a response that has you questioning whether you have any sense of style at all—ouch.

But brands can use that candor to help shape their cultural relevance, according to Rishi Malhotra, founder and CEO of a teen market research platform called cafeteria.

“I’ve always been in the business of culture, and there’s nothing more cultural than this generation; how they define everything from spending to language to music to behaviors,” Malhotra, who previously worked as an exec at HBO and Luminary, told Marketing Brew.

The speed and cost of culture

For brands to identify and capitalize on cultural moments, Malhotra said the key is listening to teens in real time, since their opinions—and thus, culture—are ever-changing.

At his previous stops, including HBO and Luminary, Malhotra said he saw what went into capturing culture via market research, and he recognized two main issues with the existing process: the resources required, and a lack of fidelity in responses.

“Things were very slow. At HBO, we would do focus groups in Q1 and maybe you have it all together three months later,” Malhotra said. “But also, not only were they very expensive, but there was no way to get pure responses. If all of us form a focus group, there’s this thing called groupthink.”

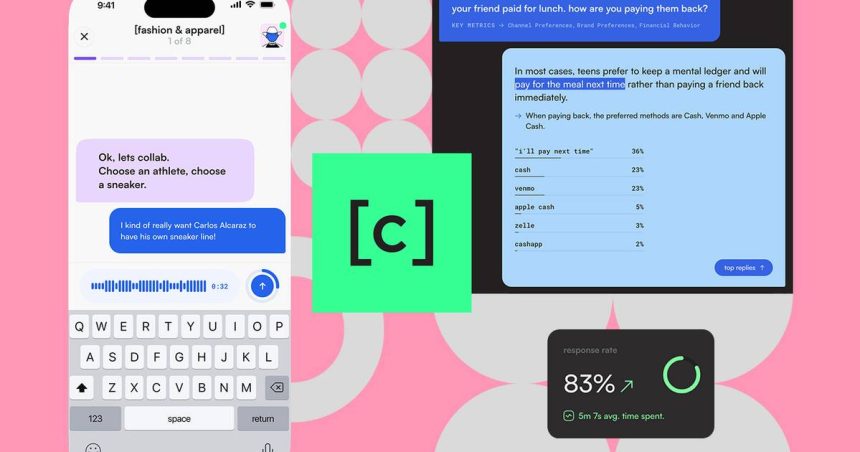

Cafeteria works by pairing teens signed up on the app with brands they’ve expressed interest in and brands that fall under similar categories. Through a series of in-app text messages and voice notes, teens answer sets of questions, called Tables, about their favorite brands, getting paid between $5 and $20 for their time. Those answers get synthesized into what cafeteria calls Albums, which can offer brands a look at currently trending and regularly updating sentiments and quantitative data from the demographic.

Malhotra says it takes teens on cafeteria an average of five minutes to complete each Table, and the majority of the responses get reported to brands within a week. Currently in its early stages, cafeteria has gathered sample insights from topics teens have naturally talked about, such as “The average Nike sneaker count per teen is 6.16, with all genders loving sneaker culture equally.“

While speed can help keep brands current, there’s also value in looking at longer-tail data, according to Chris Beer, senior data journalist at GWI, a consumer research platform that also studies the teen demographic.

Get marketing news you’ll actually want to read

Marketing Brew informs marketing pros of the latest on brand strategy, social media, and ad tech via our weekday newsletter, virtual events, marketing conferences, and digital guides.

“I think our most meaningful [trends] are the ones that are perhaps more gradual and a bit more persistent that we see in our data over time,” Beer told Marketing Brew. For example, GWI has noted that fewer teens have expressed interest in the environment and vegan food in the last few years. Because the trend was noted over a longer period of time, Beer said this type of data could be indicative of a broader change.

“The trends that are big on teens today will influence the adults that they are tomorrow,” Beer said. “It’s not just important if you’re a kind of brand targeting teens now, but you’re going to have that generation as an audience five, 10 years in the future.”

Teen talk

By putting teens in more direct conversation with brands, Malhotra is hoping to create a “continuous relationship between the two.”

“When [teens are] active participants in the brands that they love, they feel confident, and they feel like they’re listened to,” Malhotra said. “And that’s what anybody wants as a parent, and that’s what anybody wants as a brand.”

It’s not just the brands that teens are interested in that shape culture either; the way they talk about their interests holds value itself, Malhotra said. The words, phrases, and cadences through which teens choose to communicate are all valuable data points that he said can help inform how brands craft their advertising.

“If you’ve ever heard an ad that used language from a year ago and you’re, like, ‘Wow, I can’t believe that company is using that language,’ the reason that they’re using some copy that’s so old is because that’s the data they’re looking at,” Malhotra said. “But if your data is real time, then it’s going to be a lot more actionable for next-gen spenders, as we call them.”

The majority of teens are members of Gen Z, and its spending power is “expected to grow to $12 trillion by 2030,” according to a Nielsen IQ report. With a continuously growing creator economy and side hustle culture, Beer noted that teens’ spending autonomy adds “an extra appeal to understanding youth culture.”

But keeping a finger on the pulse of culture means looking ahead keeping an eye on the next generation of teens, too.

“There’s always a generation that they’re aging out of and aging into,” Malhotra said. “But they drive everything.”

Read the full article here