Tax Preparation

Your CPAs Guide To The New ERC Crisis

IRS Announces Moratorium on the Employee Retention Credit and Provides Guidance for Civil Penalty Amnesty to Withdrawing Improper Claims, Also Known As - Don’t Deposit That Check and Hire Legal Counsel The expansion and strong marketing tactics of good-for-nothing “accounting advisors” who encouraged taxpayers to qualify for the Employee Retention Credit (“ERC”) when they did not technically qualify has caused…

Wake up with our popular morning roundup of the day's top military and defense stories

Stay Updated

More Stories

With Next Tax Season Approaching, It’s Time To Apply For Or Renew PTINs

It's October, so we're thinking about… tax season? Even though that doesn't feel like it should be right, it is. The next tax season is just a few months away, which means it's the perfect time to start thinking about how to prepare. For taxpayers, that should mean reaching out…

IRA Energy Tax Credits, Part 1: History And Early Guidance

In the first of a two-episode series, Tim Jacobs of Hunton Andrews Kurth discusses the energy credits enacted in the Inflation Reduction Act and the major pieces of guidance released so far. This transcript has been edited for length and clarity. David D. Stewart: Welcome to the podcast. I'm David…

Original Landowners Move To Forefront In Conservation Easement Battles

Disputes focused on “syndicated” conservation easement transactions have existed for years, but they are far from repetitive for several reasons. One is that taxpayers organizing partnerships whose options include donating an easement tend to closely follow guidance issued by the Internal Revenue Service (“IRS”), court decisions, and other sources. Then,…

Real-Time Tax Reporting Is Coming To The U.S.: Are Businesses Ready?

There is a big data revolution quietly brewing inside the U.S. Federal Reserve that’s going to fundamentally change the way corporate tax is reported and collected in this country. It’s called e-invoicing, and it will make it possible for the government to collect detailed transactional data in real-time, automatically at…

Pro Bono Week Offers Opportunities To Make A Difference In Tax And Law

In a pivotal scene in the movie, On The Basis Of Sex, Judge Doyle, portrayed by Gary Werntz, advises, "But in those cases the courts had a clear constitutional handle. The word "woman" does not appear even once in the U.S. Constitution." Felicity Jones' Ruth Bader Ginsburg cooly responds, "Nor…

Government Surrender Leaves Questions About Foreign Gifts And Trusts

Tax laws are created by Congress, with the Internal Revenue Service (“IRS”) often required to add details by issuing regulations, Revenue Procedures, Notices, and the like. Sometimes though, input from those two sources is not enough; courts must intervene to address voids in or disagreements about the rules. Unfortunately, courts…

Does Bernie Ecclestone Belong In Jail?

“I want to be a dad again at 90, and I don’t need Viagra.” That quote is from U.K. billionaire Bernie Ecclestone, the iconic former boss of the Formula One motor-sport empire. It’s a peculiar lede for an article about international tax, but then Ecclestone is not your average businessman.…

Untangling The Hairy Situation Between Beauty Salons, Restaurants And The IRS.

Congress created a big incentive for restaurants and bars to report employees’ tips, which can be good for workers, too—even if many don’t believe it. So why hasn’t it done the same for the largely female-owned beauty industry? By Kelly Phillips Erb, Forbes Staff The holidays are coming and Paige…

The Clash Of Global Tax Visions

Robert Goulder of Tax Notes and Sharon Katz-Pearlman of Greenberg Traurig discuss the ongoing friction between the United Nations and the OECD over the U.N.'s push to play a larger role in international tax policy. This transcript has been edited for length and clarity. Robert Goulder: Hello everyone, I'm Bob…

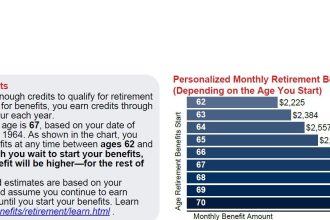

Is Social Security’s Website Suddenly Saying It Owes You Far Less?

I just received two emails, which I copy below without identifying their authors. Both authors are keeping careful track, over time, of their projected Social Security benefits as reported on Social Security’s website. Both report projected benefits that are significantly lower than those projected earlier this year. In the first…

Most Popular

Creative Ways Startups Can Earn Funding in Tough Economic Times

In a declining economy, startups face an uphill battle when it comes to securing funding.…

I Asked AI to Create a Plan for a Fake Company — The Results Blew Me Away, But Not in the Way You Might Think

With all of the recent news about artificial intelligence (AI), it got me thinking about…

Ideas To Transform You From Good To Better To Best

A while back, I took a couple of my grandchildren on a tour of the…

5 Crucial Challenges Startups Must Overcome

Startups face numerous challenges on their journey to success, and failing to overcome any one…